With an estimated 3 million leaving the country and the remaining 90% living below the poverty line, Venezuela, once a prosperous middle-income country in Latin America has found itself in the midst of a humanitarian disaster. Yet, the country sits on some of the largest oil fields in the world – making up 98% of its exports and contributing $3.1 billion in export revenue. How then can a country so rich in oil be in such a calamitous economic and humanitarian situation?

The economic theory behind this phenomenon is known as the paradox of plenty, dutch disease, or simply the resource curse. It occurs when a resource, such as oil, creates an over-appreciation in the domestic currency. This is caused by an influx of foreign money from trading the resource on the global market. The appreciation creates a structural transition away from other sectors in the economy, such as manufacturing and agriculture, since these industries are no longer globally competitive. For example, a factory owner who exports his goods to the US will suddenly find that his goods have become more expensive to US buyers. The US buyers spend their dollars elsewhere and the fall in demand causes the factory owner to reduce investment and hire less workers. Hence, labour and capital moves away from manufacturing to the booming oil business and the industry begins to collapse. This process is expedited by the government also focusing more attention on the resource industry and ignoring others sectors in the economy.

Now, this may not necessarily be a problem in the short-run. It simply represents a structural shift in the economy and the allocation of resources to a more socially optimal industry. Unemployment could rise as labour intensive industries contract but under good governing institutions the revenue from oil exports could easily support generous unemployment benefits. However, in the long-run the situation could easily deteriorate. The flagging industries often offer the most growth potential through learning-by-doing and positive technological externalities . Thus, as the economy becomes over-reliant on the resource the real engines of growth begin to fail.

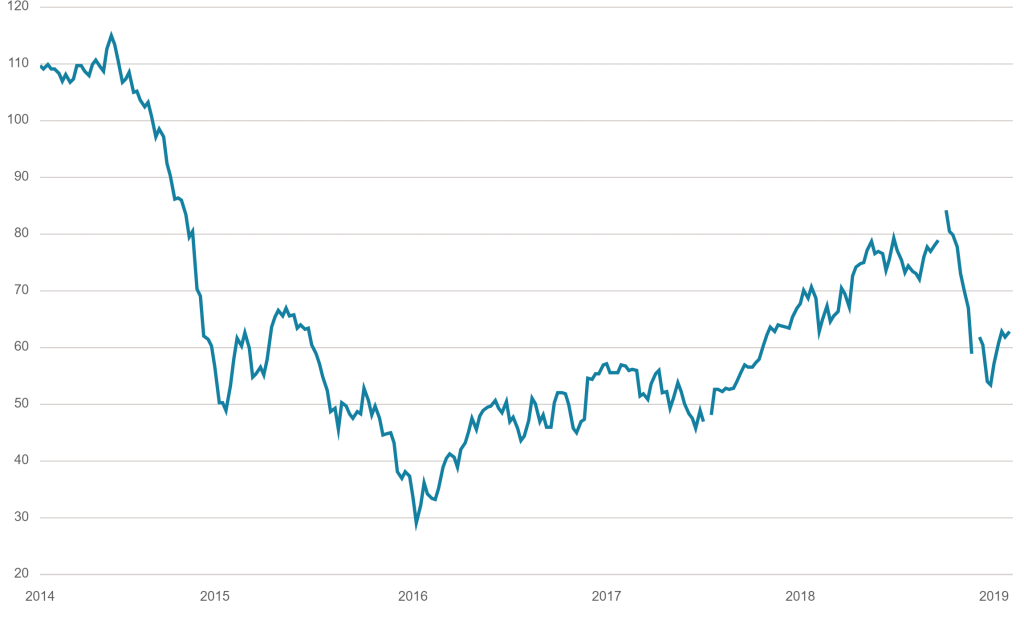

Furthermore, the problem can exacerbated greatly by the price volatility of resources. In the graph above you can see the dramatic fall in oil prices which would have significantly reduced oil export revenue in Venezuela. The oil industry, having been mismanaged for years, couldn’t cope with the shock.

These economic arguments go some way to explaining how a resource rich country can fail. However, political economy and governance is also critical in understanding the situation. The quality of institutions matter crucially for resource rich countries as they keep checks and balances on the government – curtailing corrupt despots and the like . Unfortunately, Maduro has had a unchecked grip on power for many years. This seems to be waning though and once the military abandons him then regime change will be possible. However, the economic situation is likely to remain dire for significantly longer.